We are a team of professionals that are well versed in law and finance, and we have made it our mission to help you with your filing of the Beneficial Ownership Information Report to the Financial Crimes Enforcement Network.

Basic Information*

Who must file a BOI Report?

A Reporting Company

What is a Reporting Company?

- The majority of entities that are created by filing of a document with the appropriate authority within a U.S. State or Tribe i.e. Secretary of State

- In Florida this is colloquially referred to as “Sunbiz”

- Examples in Florida include:

- Corporations

- Professional Associations

- Limited Liability Companies

- Limited Partnerships

- The majority of foreign entities that are registered to do business in a U.S. State or Tribe.

- There are a few limited exceptions (i.e. Banks, Insurance Companies, Utilities, Governmental Entities)

When must a BOI Report be filed?

- If a Reporting Company was first formed or registered before January 1, 2024, the initial report must be filed by December 31. 2024.

- If a Reporting Company was first formed or registered after January 1, 2024 but before January 1, 2025, the initial report must be filed within 90 days.

- If a Reporting Company was formed or registered on or after January 1, 2025, the initial report must be filed within 30 days.

- Any changes or corrections to the initial report must be filed within 30 days.

What is Reported?

- Basic data for the Reporting Company

- Basic data for “Beneficial Owner(s)”

- Basic data for “Company Applicant(s)” (for entities formed after January 1, 2024)

Who is a Beneficial Owner?

A Beneficial Owner is any individual who directly or indirectly:

- Exercises substantial Control over a Reporting Company; OR

- Owns or controls at least 25% of the Ownership Interest of a Reporting Company

Who is a Company Applicant?

A Company Applicant, for any entity that is formed or first registered after January 1, 2024, would always include the “Direct Filer” who files the document that creates or registers the Reporting Company with the U.S. State or Tribe.

It may also include a person who was primarily responsible for directing or controlling the filing of such document. The typical example of this distinction is that a paralegal at a law firm who files the document with the Department of State is the Direct Filer while the attorney who supervises the paralegal may be considered the person primarily responsible for directing or controlling the filing.

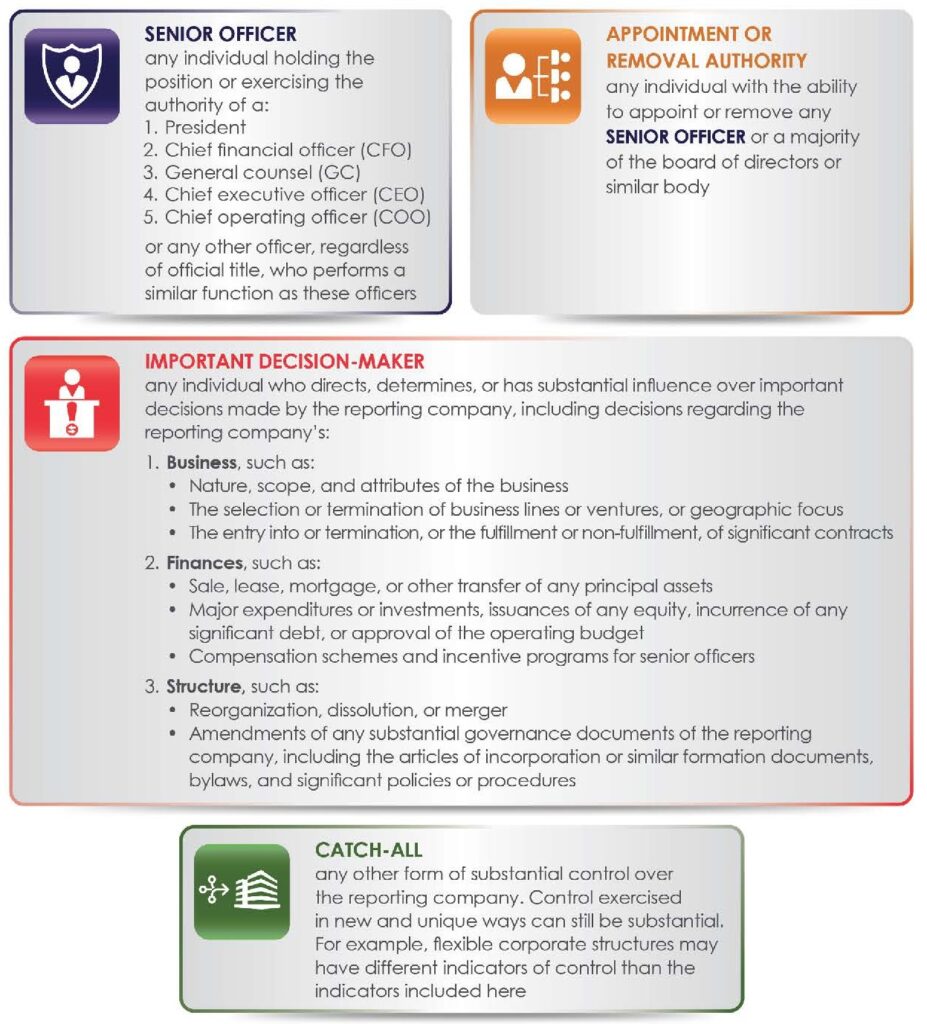

What does it mean to “Exercises Substantial Control” over a Reporting Company?

An individual exercises substantial control over a reporting company if the individual meets any of four general criteria:

- the individual is a senior officer

- the individual has authority to appoint or remove certain officers or a majority of directors of the reporting company

- the individual is an important decision-maker

- the individual has any other form of substantial control over the reporting company.

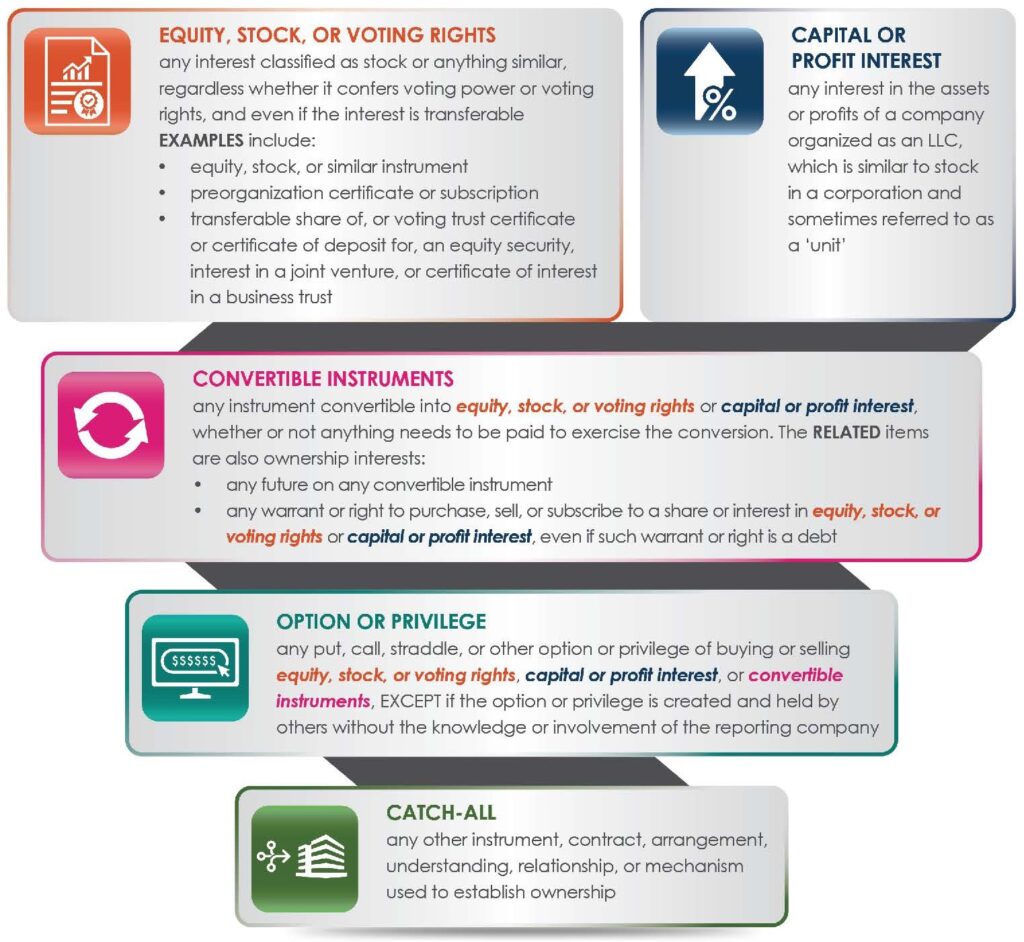

What is an Ownership Interest in a Reporting Company?

Any of the following may be an Ownership Interest:

- equity

- stock

- voting rights

- a capital or profit interest

- convertible instruments

- options

- other non-binding privileges to buy or sell any of the foregoing

- any other instrument, contract, or other mechanism used to establish ownership.

What information is reported for the Reporting Company?

- Full legal name

- Any and all trade or “doing business as” (DBA) name(s)

- Complete current U.S. address –

- principal place of business in United States

- if the reporting company’s principal place of business is not in the United States, the primary location in the United States where the company conducts business.

- State, Tribal, or foreign jurisdiction of formation

- For a foreign Reporting Company only: State or Tribal jurisdiction of first registration

- Internal Revenue Service (IRS) Employer Identification Number (EIN)

- If a foreign Reporting Company has not been issued a TIN, report a tax identification number issued by a foreign jurisdiction and the name of such jurisdiction.

What Information is reported for the Beneficial Owner(s) and Company Applicant(s)?

- Full legal name

- Date of birth

- Complete current address

- Report the individual’s residential street address

- Applicants who form or register a company in the course of their business, such as paralegals report the business street address.

- Unique identifying number and issuing jurisdiction from, and image of, one of the following non-expired documents:

- U.S. passport

- State driver’s license

- Identification document issued by a state, local government, or tribe

- If an individual does not have any of the previous documents: foreign passport

OR

- FinCEN ID

Whats is a FinCEN ID?

A FinCEN ID is a unique identifier, issued by FinCEN that can be provided to the Reporting Company to be used, in lieu of the detailed personal information, for Beneficial Owners and Company Applicants.

An additional benefit is that, whenever a Beneficial Owner’s data changes, only the FinCEN ID data has to be updated, instead of each Reporting Company having to file updated BOI Reports to update the personal data for the Beneficial Owner.

What are examples of changes that require filing of subsequent BOI Reports?

- Changes to the Reporting Company’s data, such as

- the relocation of the company

- addition or change in Beneficial Owner(s) (such as through change of corporate officers, change in ownership such as through a sale or death of a shareholder, etc.)

- Changes of the Beneficial Owner’s data such as

- a name change due to marriage/divorce

- change of the home address

- change in the unique identifying number (i.e. by issuance of a new Passport or Driver’s License)

- NOTE: In this last example, a new copy of the document must also be submitted.

- If a Beneficial Owner obtained a FinCEN ID, the Beneficial Owner must update their data whenever it changes.

Where can I go for more Information?

All the data contained in this section was pulled from the FinCEN Small Entity Compliance Guide Version 1.1 reproduced here:

Our Services:

What services do we provide?

We provide you with the basic information about what is needed for BOI Reporting compliance with the Financial Crimes Enforcement Network, as published in FinCEN guidance.

We obtain the necessary data from the Reporting Company regarding such company, its Beneficial Owner(s) and Company Applicant(s) and then file the BOI Report on behalf of the Reporting Company.

What do we NOT do?

We only provide assistance with the ministerial act of filing the BOI Report. We do NOT provide any legal advice regarding the status of any Reporting Company or any Beneficial Owner. If there is any doubt whether a company is a Reporting Company or whether an individual is a Beneficial Owner, such entity or person must retain competent legal counsel to make such determination.

What does it cost?

Filing of an initial BOI Report, with up to a total of four individuals (Beneficial Owners/Company Applicants) costs $375.

Any additional Reporting Companies with the same individuals, filed at the same time, costs $250.

Filing an amended or corrected BOI Report, after we have previously filed the initial report, costs $225.

If you are filing for more than three entities, or more than four individuals, please contact us to discuss package pricing.

Getting Started:

The Process:

If you are ready to have us file your BOI Report for you, please complete the below questionnaire regarding the Reporting Company. Once received, a member of our team will setup the entity in our secured portal “MyCase” and will send out a registration e-mail.

Once you are registered with “MyCase” you will receive our terms and conditions for e-signature as well as an intake form that will provide us with the detailed information to be reported for the Reporting Company, Beneficial Owner(s) and Company Applicant(s). Lastly, you will upload the respective identifying document(s) through the secured portal.

Once the report is ready to be filed, you will receive an invoice. Upon payment of same, we file the report on your behalf and provide you with confirmation, once the report has been filed.

It’s really that simple!

*Nothing contained herein is considered legal advice and all services provided are subject to our Engagement Letter and Terms and Conditions. If you have any questions about your filing obligations, please consult an attorney.